More people are using their bikes to ride to work & school as well as for leisure and enjoyment. In addition the value of bicycles and accessories is increasing, this makes them more of a target to thieves. As bike ownership costs increase, the need for cycle insurance becomes more prevalent.

Isn’t My Bike already covered by Household Contents Insurance?

Household Contents Insurance often only pays a small percentage (often up to £500) of an expensive bike’s actual worth. In addition home contents cover often excludes bikes when they are:

- In use, on a ride – (eg outside a cafe or shop)

- Taking part in a sportive or race

- Damage whilst being used

- Cause damage to someone else

It might be possible to increase the cover value of the bike on the household contents insurance if you specify the bike and its value to your insurer. Your Contents Insurance provider might add bicycle crash damage into the policy – It is worth asking your current insurer. If not it could well be worth looking at a specific Cycle Insurance policy.

What’s Covered by a Standard Cycle Insurance Policy?

Specific bike insurance typically covers your bike; in the event of it being stolen, suffering malicious or accidental damage, bike hire replacement. Insurance companies usually offer ‘new for old’ replacement, however they sometimes they can deduct an amount for wear and tear. Double check if your policy is new for old before you agree the cover.

Which Extra options Suit you?

Just like when you bought your bike, there are quite a few different options when it comes to Cycle Insurance extra cover. Draw up a list of options which you need. Some insurers offer multi bike discounts, handy if you need to cover several bikes. Most insurers cover all types of bike from E-Bikes to BMX’s. To get the most out of your policy, think about how you use your bike and which of the following cover options / features would be useful;

- Maximum Value per bike – Will your expensive bike be fully covered or just a percentage of its value?

- Accidental Damage – We all make mistakes… will it be covered…

- Cover Abroad – Bike Cover for an overseas holiday, don’t let a clumsy baggage handler ruin your trip.

- Event Cancellation – Take some of the pain out of a cancelled event with event cancellation coverage.

- Cover during Racing / Events – Event coverage is one less thing to worry about, allowing you to focus of the event.

- Accessory Cover – Your expensive GPS, Helmet, Shoes, Spare Wheels…. The cost of accessories can be huge, make sure they are covered.

- Liability Cover – Should you have an accident and cause damage to someone else’s property, liability cover will protect you from expensive costs.

- Medical Costs – If the worst happens and you need medical attention following an accident, medical and dental cover can be very useful.

- Replacement Bike Hire – How can you still ride when your bike is stolen? Replacement bike hire could get you back on the road quickly.

- E Bike Cover – Got an expensive new E Bike? Number 1 target for thieves, make sure your policy includes E Bike cover.

- New for Old? Getting a brand new bike to replace your stolen, well used one, can uplift your spirits. Make sure your policy is new for old.

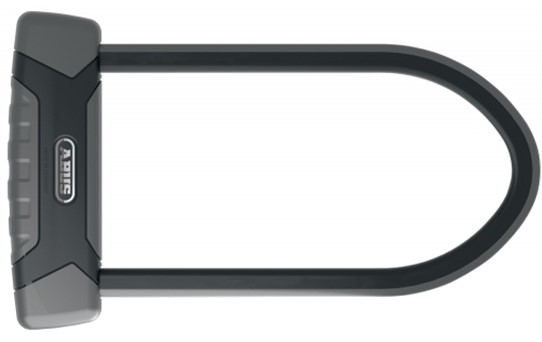

- Specific Lock requirement? Some Insurers specify the lock required for the policy to be apply. Make sure you have the right lock to keep them happy.

How Much Does it Cost?

There are many factors which influence policy price (see Below). An example of a £1000 commuter bike used in central london could be a couple of hundred pounds per year. The same value bike used for leisure on a weekend in a remote part of the UK could well cost much less.

What affects the Price?

Just like Car Insurance, Cycle insurance costs vary depending on; where you live, where your bike is kept, is it always locked?, previous claim history, value of bike / accessories, how often it is used, type of lock.

Do I Have to Pay an Excess?

Yes. All insurance companies will charge an excess when you make a claim. Insurance companies use three alternative methods for calculating the excess; A percentage of the value of the bike. A flat rate amount. A set rate upto a set value (eg £100 excess for bikes up to £1500)

Key Cycle Insurance Providers

We have no affiliation with any insurance supppliers, the links below of suppliers is intended as a guide and not a recommendation.

Pedalsure have a 4.5 score on Trustpilot and have been providing cycle cover since 2014.

Sunday Insurance offer exclusive deals for Strava members and a wide ranging raft of policy options.

Laka offer a community based insurance service, adaptable each month to fit circumstances and cover requirements.

Bikmo have a 4.6 score on Feefo and have a customer service team made up of bike geeks.

Yellow Jersey have 3 levels of bicycle cover and seperate travel cover for cyclists. They also boast a 4.6 score on Feefo.

Velosure have a 4.7 rating on Feefo and offer a wide range of inclusions in their cover options.

Hiscox Insurance offer Home Contents Cover which including bikes up to a value of £15k. A good option to combine home contents and bike.

As with other insurance products, shop around and get the deal that is best suited for you.

Association Insurance

Both British Cycling and Cycling UK offer insurance as a part of membership along with other member benefits. Check out what they offer here;

Love It? Lock It!

Insurance companies require that your bike should be locked to a secure object, for it to be covered for theft. Check out our range of bike locks here.

There is a wide range of locks available. Don’t make the mistake of trusting a cheap lock / padlock to secure an expensive bike. Many riders who have to leave their bikes locked and unattended, choose to buy a cheap, reliable bike for commuting rather risk their pride and joy.

Secure Locking

Make sure your lock is attached to something non-movable which it can’t be lifted over or easily cut through. Ideally, purpose built bike parking locking plates. Locking through both the frame and wheels is the best way to deter a bike thief, they will look for an easier option.

If possible, lock it where it can be seen by yourself or a work mate. Or at the very least somewhere with a high volume of foot traffic passing by. Lock the bike with the lock mechanism off the ground and facing downward & out of sight.

If you keep your bike in an out-building / garage at home, many insurers stipulate that it must be locked to an anchor point which is fixed and imovable (concrete floor base for example).

Gaps in Insurance Cover

There are several potential issues which can result in Insurance cover not being valid.

- If you use your bike for monetary gain (eg Food Delivery)

- Lack of proof of ownership (Receipt from purchase)

- Dents / scratches which dont effect how the bike is ridden

- Damage to accessories unless the bike is damaged at the same time

- Theft of Bike if not secured properly

- Any accidents while under influence of drink or drugs

Remember to notify your insurer if you update your bike / accessories to ensure that the policy is still valid.

Beware Strava Stealers

Many of us have become very reliant on the Strava app for logging training rides. However, make sure that you start and finish strava rides away from your home. Giving bike thieves your address (where your strava rides start and stop) as well as pictures of your bikes in your timeline, can make things too easy for the potential bike thief. Check out this story on Road.CC.